Tariff U-Turn: Investment Implications

Markets likely to rejoice tariff exclusions -- Reminder to focus on the long-term and stay diversified

The U.S. government is finally paying attention to the market’s tantrums and warnings from CEOs and economists. Had the announced reciprocal tariffs been implemented in full force, the U.S. economy would have taken a significant hit with weaker spending and higher prices. Global supply chains would have been severely disrupted, and financial markets could have faced crisis conditions.

Firstly, on 9 April, President Trump announced a 90-day pause in reciprocal tariffs for countries except China. And then, over the weekend, we learnt that smartphones, laptops, and related components would be excluded from reciprocal tariffs.

The market rejoiced the 9 April pause announcement and will likely react positively to this weekend’s exclusion news.

In addition to the above reprieves by the U.S. government, the Federal Reserve also sought to calm financial markets. In a Financial Times interview, Boston Fed President Susan Collins said, “The Fed would absolutely be prepared to deploy its various tools to help stabilize the financial markets if the need arose.”

The Fed will be laser-focused on volatility in the bond markets, and its first course of action may be to stop reducing the size of its balance sheet (i.e. ending quantitative tightening).

The tariff reprieves and the Fed interview are likely to help financial markets stabilize in the near term.

However, investors cannot be complacent. Consumer, business, and investor confidence have already taken a hit, which will weigh on the economy. Further, the tariff pause is temporary, and trade deals still need to be worked out.

A key lesson from this episode is that many things are unpredictable, and narratives can change quickly. Thus, it is essential to focus on the long term, diversify among different asset classes, and choose quality investments at appropriate valuations.

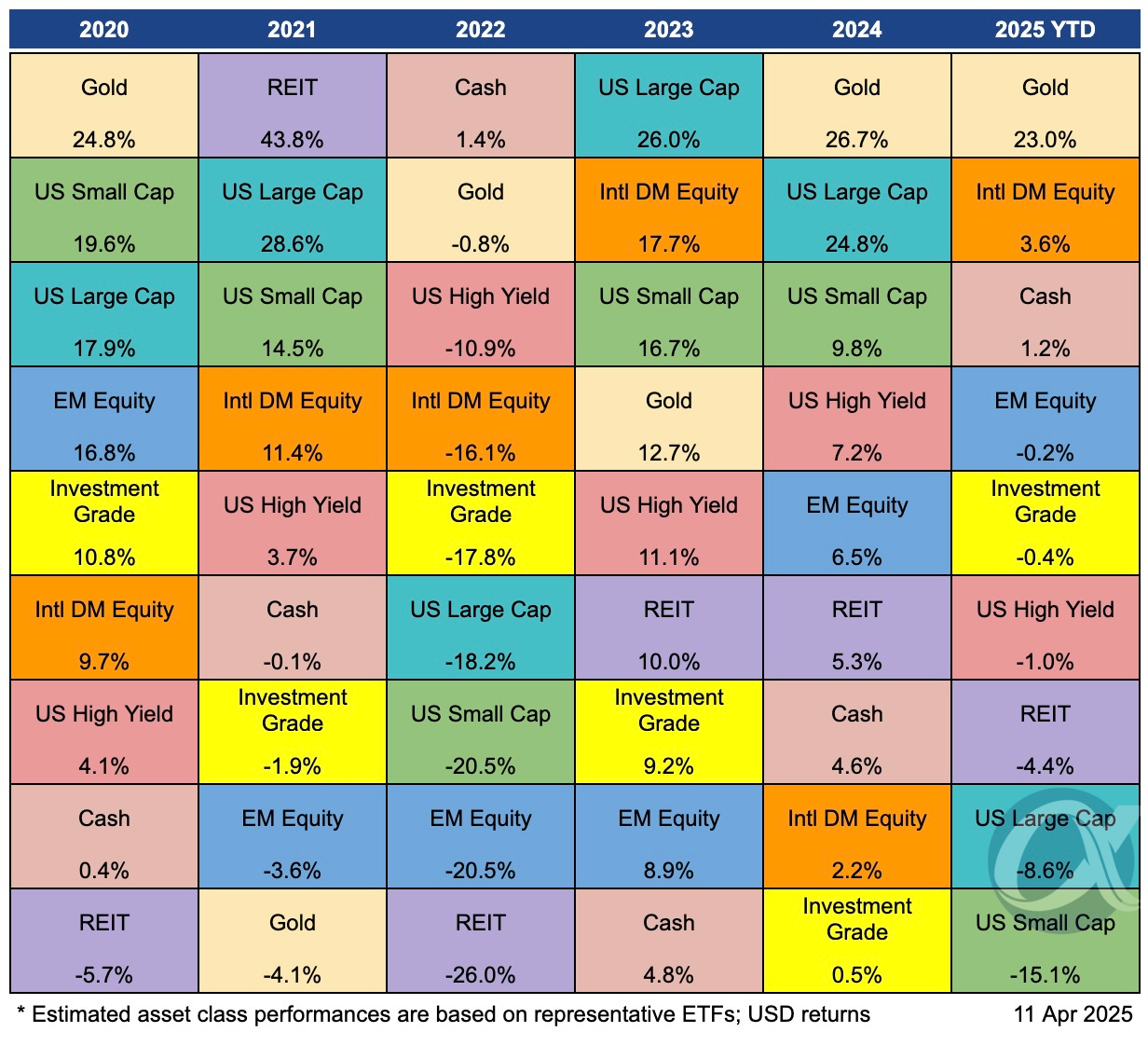

Diversifying in different asset classes can help reduce portfolio volatility allow you to take advantage of opportunities when they arise. The table below summarises the performance of major asset classes (in USD terms). For more on asset allocation see our earlier post.

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.