Excel by Keeping Investment Expenses in Check

Recent study finds hedge fund investors paid half of their returns in fees

When investing, a series of fees and expenses are incurred. These may not seem significant at first glance, but they can significantly impact your portfolio's performance in the long term.

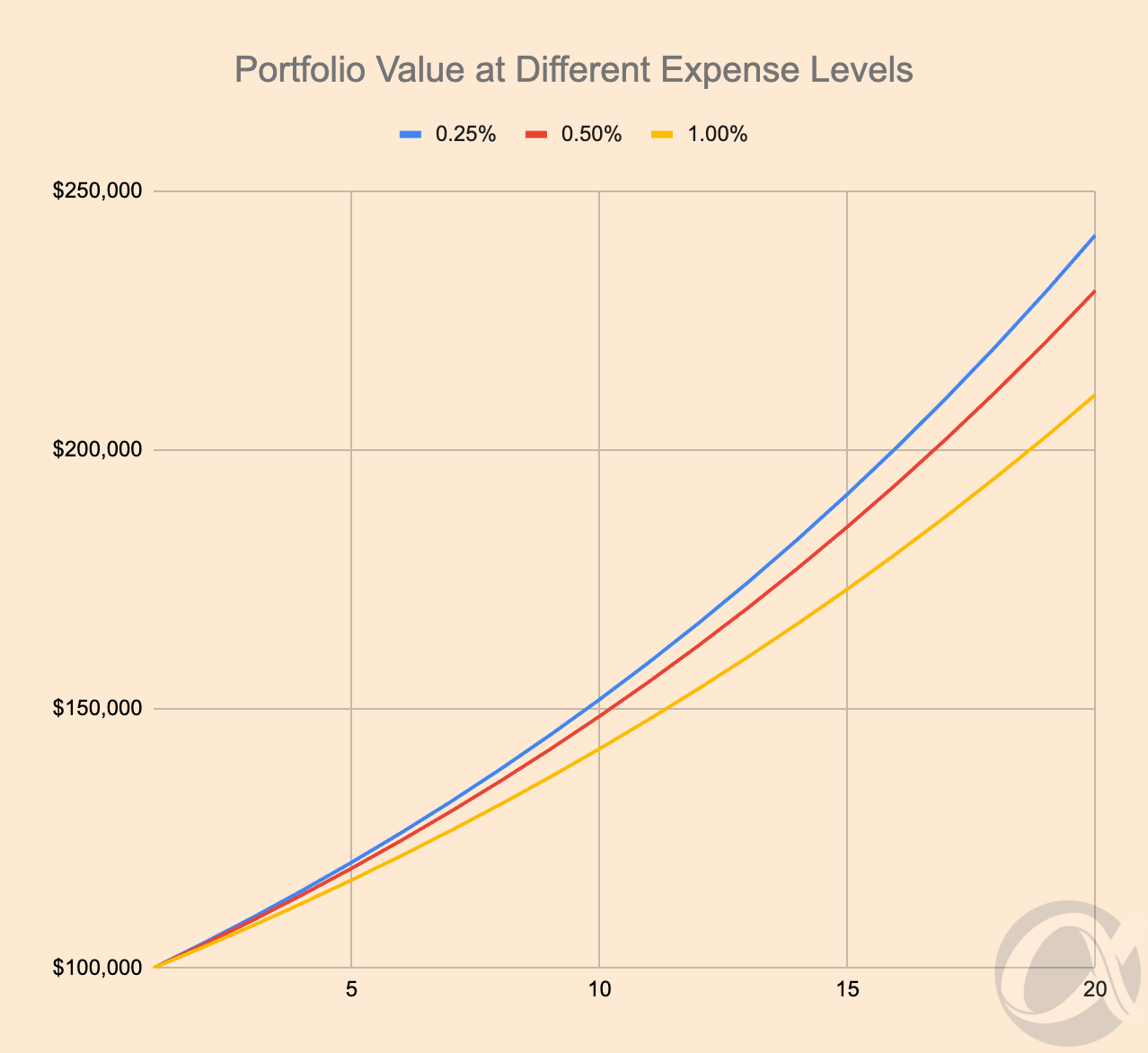

This is illustrated in the graph below, which shows the impact small differences in expense levels can have on performance. In the example, we look at a portfolio with a gross return of 5% per year over 20 years and see the impact of three different annual expense levels: 0.25%, 0.50%, and 1.00%. In each case, the starting value of the portfolio is $100,000.

As seen, over 20 years, the difference between a 0.25% and a 1.00% expense level is significant. At the end of the period, there is a $33,000 difference between the two portfolios—that is 33% of the starting value!

In another example of the impact that investment expenses can have on performance, LCH Research recently found that investors in the hedge fund industry have paid about 50% of their gross returns in fees.

According to the report, between 1969 and 2024, hedge fund managers generated $3.7tn of gross returns (i.e. gains before fees) but charged investors $1.8tn in fees. This reflects the industry's high fee structure, including performance fees.

These are some of the charges which may be incurred and should be considered by investors when choosing investment options:

Commissions / Sales Load / Mark-Up: These are typically transactional expenses charged when making an investment.

Advisory Fees: Fees paid to an advisor for managing your portfolio or investments.

Management Fee / Operating Expense: These are fees paid to the manager of mutual funds and exchange-traded funds (ETF) to cover fund management fees and other expenses incurred.

Performance / Incentive Fee / Carried Interest: A fee over and above the management fee that a manager charges upon achieving certain performance targets. This is often calculated as a proportion of the return generated.

The growth of the exchange-traded fund industry has opened lower-cost investment options for investors. ETFs are generally cheaper than other fund products due to efficiencies, including passive management styles and very large fund sizes.

Consider Vanguard's recent fee cut to get an idea of how low ETF expense ratios can be. The American asset manager, with over US$10 trillion in assets under management, reduced annual expense ratios for a host of its ETFs to under 0.10% per annum.

In announcing the cost reductions, Vanguard also re-published a quote made by its founder, John C. Bogle, in a 2005 speech (posted below for your reference):

While costs can clearly play an important role in determining returns over the long term, they are only one factor. Investors should carefully consider all expenses, assess their merits, and compare alternatives.

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.