Your Financial Future Depends on the Right Asset Allocation

Asset allocation determines up to 90% of portfolio returns, according to studies

Without considering your overall asset allocations, excellent stock-picking prowess alone may still result in a suboptimal investing outcome.

When building and managing a portfolio, it is vital to consider the overall allocation to different asset classes. This means strategically considering the overall proportion of bonds, equity, commodities, real estate, and cash. Once the size of each bucket is decided, individual investment ideas can be considered.

Multiple studies have concluded that the asset allocation process is the most important factor in portfolio performance — It is quite simple to understand why:

Even with well-informed stock selection, a 100% equity-focused portfolio would be extremely susceptible to a stock market correction or crash. With a component of cash, bonds, and real estate, the same portfolio could have held up better—even potentially achieving positive returns and allowing one to take advantage of equity weakness.

The above is predicated on the premise that different asset classes are not perfectly correlated (i.e. their returns do not move in perfect unison—either in the same direction or in opposite directions—over time). So, it is possible that while equities may have had a negative return in any one year, other asset classes may have had positive returns.

This is captured in the table below, which shows the performance of various asset classes in US dollars over the past 10 years. The data for each year is ranked from best to worst performer.

Two important takeaways are: 1) Returns for any one asset class vary significantly from year to year, and 2) Outperforming assets in one year do not necessarily retain the top spot in subsequent periods.

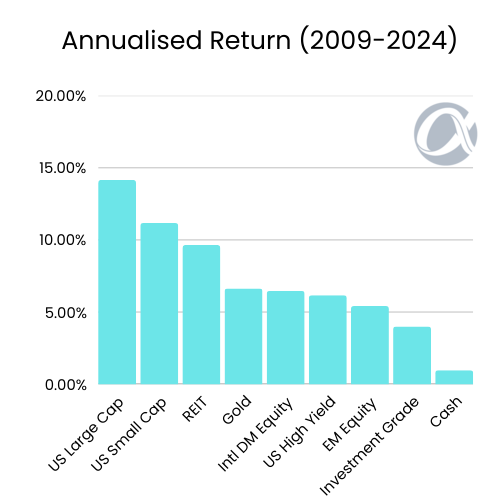

If we look at the annualised performance of each asset class over the 10-year period, the picture looks like this:

However, it would be incorrect to conclude that since US large-cap equities have historically provided the highest annualised returns through ups and downs, one should overweight this asset class.

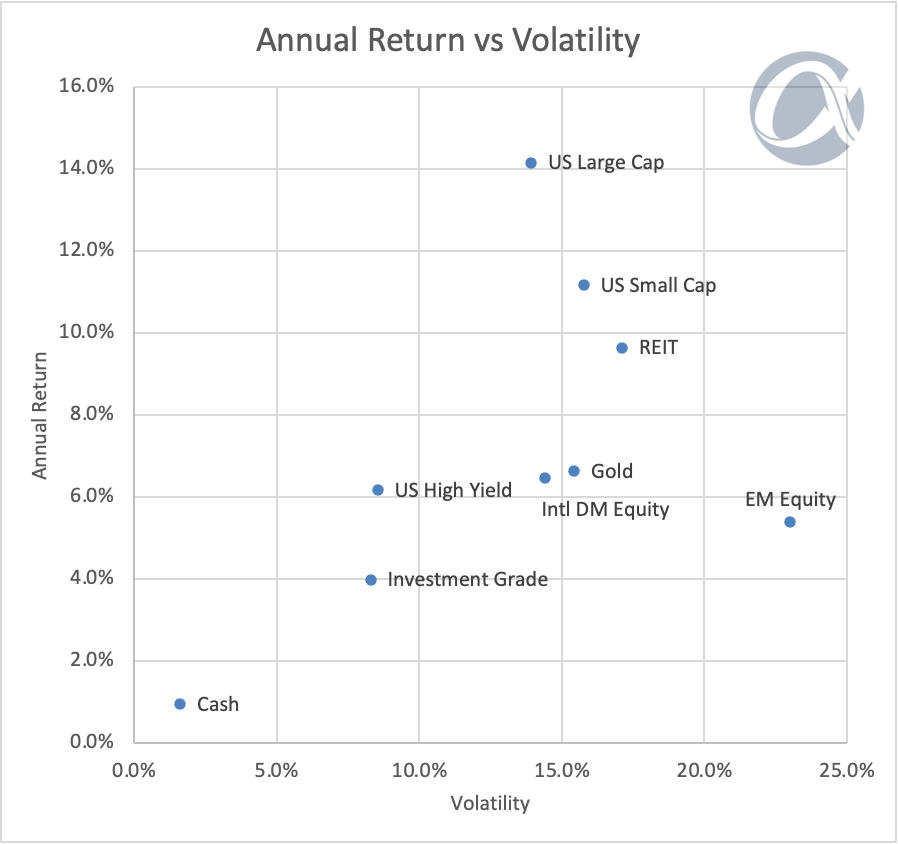

We also need to consider the respective risk profiles when evaluating asset allocations. One way of doing so would be to consider the volatility of returns, as shown below—clearly, equities also have the highest risk.

While returns and risk profiles for different asset classes can be considered as above, they are only generalised observations. The application in portfolio building for each individual is far more nuanced.

Some of the factors to be considered include:

Age / Time Horizon: Generally, a younger person at the start of their career or any portfolio with a longer-term horizon can benefit from a higher allocation to assets with higher expected returns despite the associated volatility. This is because there is a reduced need to access funds from the portfolio in the short term. Thus, there is time to ride out volatility and also recover from any temporary declines.

Risk / Tolerance: Investors less able or willing to suffer portfolio losses should favour lower-risk asset classes such as bonds and cash.

Market Cycles: Markets are cyclical. Hence, investors can also adjust portfolios based on the starting valuations of different asset classes. For example, when bond yields are relatively high and/or equity valuations are stretched, investors may consider tactically upping bond allocations relative to equity.

The above summarises some of the factors to consider in determining one’s asset allocation and is not intended to be comprehensive. Investors should look at their portfolio as a whole rather than siloing (or compartmentalising) different investments and regularly review the asset allocation. Geographic, sector, and currency allocations must also be active considerations.

Finally, this is only a general guide to asset allocation to assist you through the process. It is highly recommended that you consult a financial advisor who can tailor an asset allocation plan specific to your circumstances.

Disclaimer:

All content, information and opinions provided on Fincoaster are for informational and educational purposes only. Nothing contained herein is investment advice or recommendations. No guarantee is provided about the accuracy or completeness of the information provided. Readers should consult their financial advisers to ascertain the suitability of any investment.

Contributors to Fincoaster may, from time to time, have positions in any investments discussed.

Fincoaster is operated and managed by Envision Ventures Limited.